How to Win a Financial Crimes Case

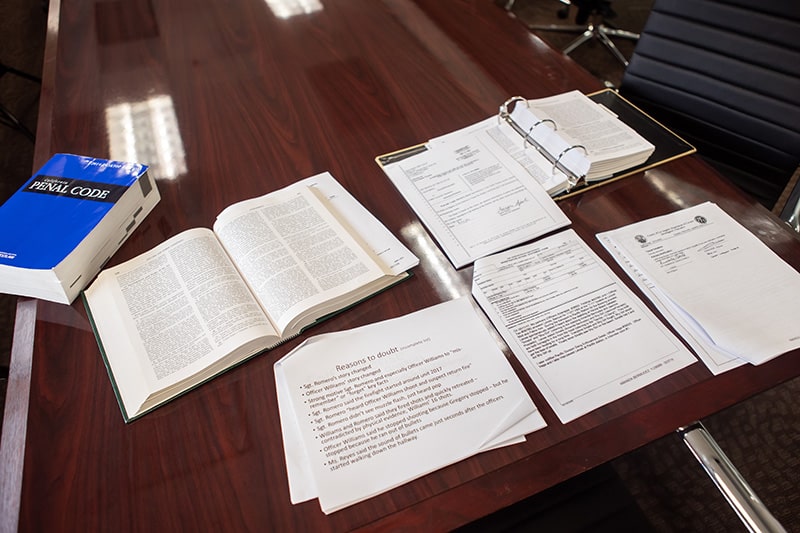

In many cases, the defendant is factually innocent, and the best California financial crimes lawyers can utilize strategies to keep a conviction off their record. One of California’s top criminal defense attorneys, Aaron Spolin, explains how to win a financial crimes case: “We use three strategies: (1) file effective legal motions to dismiss a case or get evidence excluded; (2) use evidence against the prosecutor’s charges; and (3) develop a strong defense strategy.” Mr. Spolin has successfully used this process many times with former clients. (Every case is unique, and prior success is not a “guarantee” of the same outcome on a future case.)

Mr. Spolin explains how his strategies work:

- Filing Effective Legal “Motions”: Legal “motions” are requests to the court to take an action. Common pre-trial motions used before the trial even begins to include a Motion to Dismiss and Motion to Dismiss (or Suppress) Evidence. Mr. Spolin and his team utilize factual evidence and the law to support their motions.

- Using Evidence Against the Prosecutor’s Charges: Investigators may gather evidence against you and the prosecutor will try to pin as many charges to you as possible. However, top financial crimes attorneys will evaluate that evidence differently. Experienced lawyer Don Nguyen, of Spolin Law P.C., often considers how evidence is gathered and whether his clients’ rights were violated in the process. There are many aspects that can be considered when using the prosecutor’s own evidence to disprove the charges against you.

- Developing a Strong Defense Strategy: In a financial crimes case, it is not necessary to prove that you are innocent, but simply that you are “not guilty.” The prosecutor has the burden of proving “beyond a reasonable doubt” that you committed a crime. Spolin Law P.C. attorney Jeremy Cutcher knows how to plant the seed of doubt in the jury’s mind that will encourage them to find clients not guilty.

To learn more about how these strategies might apply to your case, call Mr. Spolin, Mr. Nguyen, or Mr. Cutcher at their law firm, Spolin Law P.C.: (310) 424-5816.

- How to Win a Financial Crimes Case

- Types of Financial Crimes in California

- Defenses to Financial Crimes Charges

- Learn About Leading Financial Crimes Attorneys

Types of Financial Crimes in California

A good financial crimes attorney will know California laws, and they will understand how they may or may not apply to your case.

Financial crimes are often also categorized as “white-collar crimes.” This is because they are generally non-violent in nature and committed for financial benefit by a person who works in an office or otherwise, wears a shirt with a collar (hence “white-collar”). This is not always the case, though. Spolin Law P.C. represents clients will all backgrounds who are accused of financial crimes.

Some common financial crimes Spolin Law P.C. handles for clients include the following.

Financial Fraud Offenses

Fraud includes acts that result in unfair or undeserved benefits and financial harm or loss to another person. Fraud offenses are generally driven by financial gain and efforts to escape criminal culpability.

Some California fraud crimes include:

- Insurance Fraud (Auto Insurance Fraud, Health Care Insurance Fraud, Unemployment Insurance Fraud, Medi-Cal Insurance Fraud, Welfare Fraud, Workers’ Comp Fraud, etc.)

- Real Estate & Mortgage Fraud (Foreclosure Fraud, Forged Deeds, Predatory Lending Schemes, Illegal Property Flipping, Rent Skimming, Straw Buyer Schemes, etc.)

- Check Fraud

- Credit Card Fraud

- Securities Fraud

- Forgery & Counterfeiting

- Counterfeiting Driver’s Licenses or ID Cards

- False Personation Law

- Internet Fraud

- Nursing Home Fraud

- Mail Fraud

- Handicapped Parking Fraud

- Fraudulent Vehicle Registration Stickers

- Gambling Fraud

- Telemarketing Fraud

- CARES Act Fraud

Embezzlement — Penal Code 503 PC

California Penal Code 503 PC states that “[e]mbezzlement is the fraudulent appropriation of property by a person to who it has been entrusted.” Embezzlement is different than other types of theft because the money or property that is stolen is legally possessed or accessed by the person who has been accused of embezzlement. That possession or access of the money or property was part of the person’s job responsibilities.

The level of charges and penalties faced for embezzlement depends on the amount of money or value of the property that was involved. For example, a first-time conviction that involves less than $400 may result in a small fine, probation, and community service. However, a second offense with more value involved may be charged as a felony and can result in between one year in county jail or up to three years in state prison.

Theft Crimes

Many theft crimes are financially motivated as well. A defendant may be accused of stealing money, stealing property to sell it for money, or simply stealing high-value items.

Common theft crimes that Spolin Law P.C. handles include:

- Burglary (Penal Code 459 PC)

- Grand Theft (Penal Code 487 PC)

- Petty Theft (Penal Code 484 PC)

- Receiving Stolen Property (Penal Code 496 PC)

Identity Theft — Penal Code 530.5 PC

Identity theft is defined as taking a person’s personal identifying information (name, address, telephone number, address, driver’s license number, passport information, etc.) and using it in an unlawful or fraudulent manner. Some examples include signing someone else’s name on a check or giving a police officer someone else’s driver’s license instead of your own.

This crime is a wobbler, which means it can be charged as either a misdemeanor or felony. Penalties are greatly dependent upon how the prosecutor charges this crime. A misdemeanor will only face up to one year in county jail; however, a felony charge could result in up to three years in prison. Instead of incarceration, you may be able to negotiate a penalty of probation.

- How to Win a Financial Crimes Case

- Types of Financial Crimes in California

- Defenses to Financial Crimes Charges

- Learn About Leading Financial Crimes Attorneys

Defenses to Financial Crimes Charges

The attorneys at Spolin Law P.C. work to develop strong legal defenses that can lead to a dismissal or acquittal of your charges. Successful defenses that may be used in your case will depend on the facts of your situation.

Some legal arguments Mr. Spolin, Mr. Nguyen, and Mr. Cutcher may use to support your financial crimes case include the following.

There Was No Intent to Commit a Crime

Intent is a key element of most criminal charges. If we can show that you did not intend to commit fraud, the prosecutor will not be able to prove you are guilty of the crime. Without intent to take the specific actions described in the statute, the jury is not likely to find guilt.

Victim of Mistaken Identity

Many innocent people are accused of crimes that they did not commit due to mistaken identity. People who witness crimes are often confused due to heightened emotions in the moment. Later, they identify defendants or make accusations based on misinformation or guesses.

Both photo and live lineups, which are often used to identify suspects, are commonly completed in an invalid manner. It’s important to challenge the process and results of these lineups.

Entrapment

California allows for the legal defense of entrapment if you can show that you only committed a crime because the police lured or coerced you into taking certain actions. For example, if an undercover police officer relentlessly and overzealously begs a coworker for money they are entrusted to deposit, and the coworker does so reluctantly due to the coworker’s harassment, then the accused individual may be protected by California’s entrapment laws.

- How to Win a Financial Crimes Case

- Types of Financial Crimes in California

- Defenses to Financial Crimes Charges

- Learn About Leading Financial Crimes Attorneys

Learn About Leading White-Collar Crimes Attorneys

Financial offense charges are often brought against good people who didn’t actually intend to commit a crime. These white-collar crimes can damage a person’s personal and professional life.

Spolin Law P.C.’s financial crimes attorneys have a record of successful outcomes. We get successful outcomes because:

- We know the law. California financial crimes incorporate specific elements that the prosecutor must prove to get a guilty verdict. We know these crimes inside and out and understand how to use motions and defenses to get charges thrown out and cases dismissed.

- We protect our clients. White-collar crimes are often highly publicized, and our clients face scrutiny even before the trial. We will develop strategies to manage the media as well as other aspects of our clients’ lives while charges are pending.

- We know how to present a case in court. Our record of success extends beyond pre-trial activities. We also know how to approach court hearings and present information to a jury.

If you have questions about your case, contact Mr. Spolin, Mr. Nguyen, or Mr. Cutcher at the law firm, Spolin Law P.C.: (310) 424-5816.